21 Finance and Funding Tips for Canadian Tech Startups

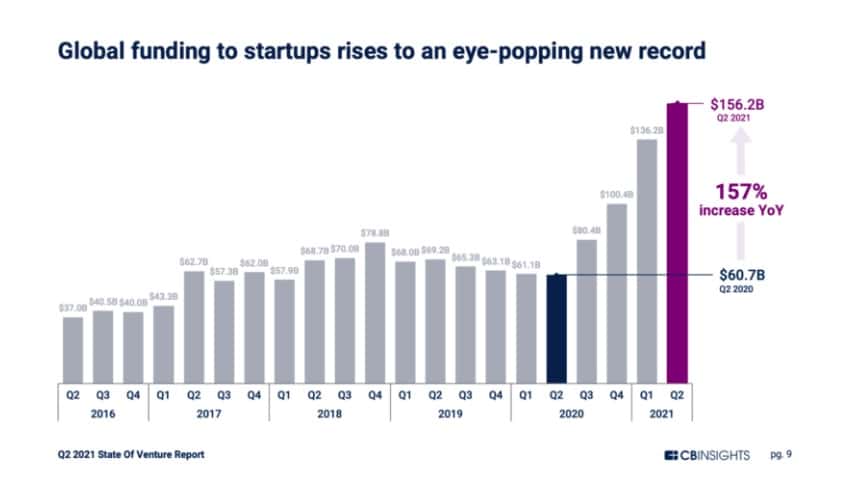

2021 was the year for Canadian Tech Startups, with record-breaking funding of $156.2 Billion.

Q2 2021 saw a whopping 157% YoY increase in the funding of Canadian startups.

Source: CBInsights

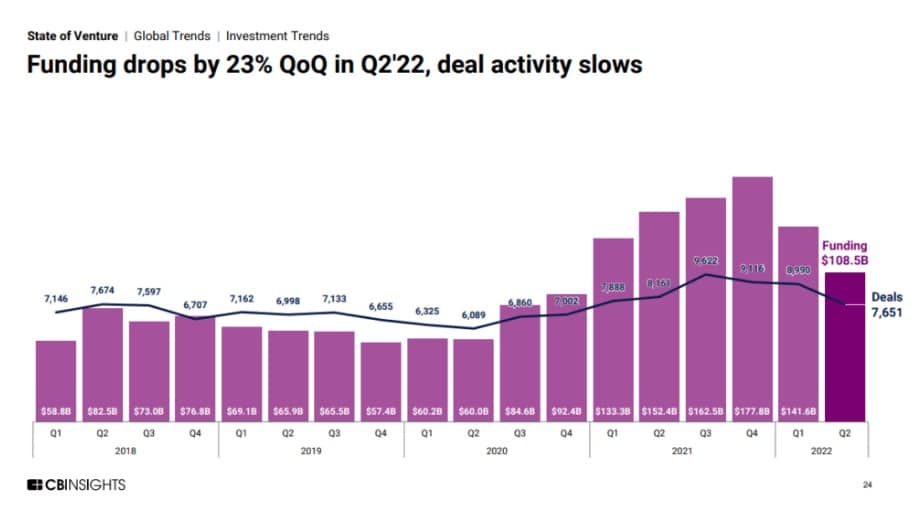

However, things have gone south since Q1 2022, with a steady decline of 23% QoQ in the funding.

Source: CBInsights

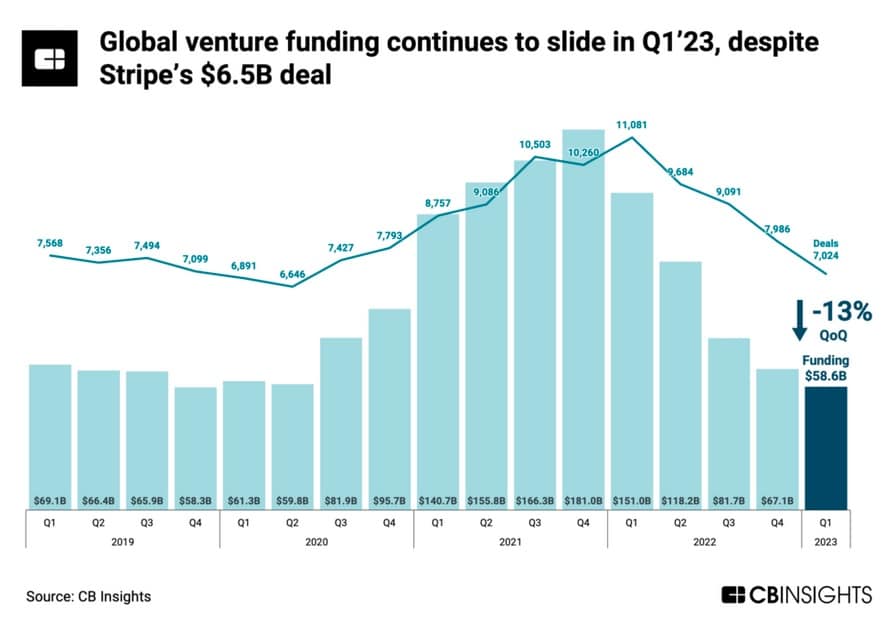

The decline has been continuous even in Q1 2023. However, it is less steep than the previous year, with a 13% QoQ decline.

Source: CBInsights

High-interest rates, inflation, and the recent collapse of Silicon Valley Bank (SVB) have choked funding.

SVB’s Canadian Division has invested in the growth of Canadian Tech Startups. But, unfortunately, its sudden collapse has left a void in the market.

Investors have become selective in funding tech startups, fearing a recession. At such challenging times, securing funding and scaling becomes a daunting task.

But by keeping your finances in good condition, you can increase your chances of funding even in the current market conditions.

Here are 21 Finance and Funding Tips for Canadian Tech Startups that you can follow to secure and increase your chances of receiving investment.

1. Keep Finance Budgeting Realistic

While budgeting, make sure to track even the smallest of expenses. Keep a buffer for unexpected costs. Assuming ideal case scenarios all the time makes finance budgeting worse.

Take help from expert Financial Consultants / CFOs with extensive budgeting experience. They will help you get the budgeting right.

2. Stick to the fundamentals

Investors will want evidence that your startup has a solid business model. There should be a clear path to revenue growth and a talented team to execute the plans. Focus on building a solid foundation for your startup and demonstrating traction.

Download your copy of the Profitable SaaS Financial Model + Template to create strong financial foundations in your startup.

3. Steady Cash Flow

Cash flow management is crucial. To run the operations, a steady cash flow is a must. So monitor the cash flow and keep an eye on your cash runway. Investors will often pay attention to things like burn rate and cash efficiency.

Also Read: 5 Cash Flow Metrics to Prioritize and Track in Your Startup

4. Practice Cost-Effectiveness

Be Frugal! Often businesses overspend in the name of scaling. Determine the cost-efficiency and ROI of any overhead before spending money on it. In the initial stages, being frugal helps maintain a healthy cash flow. This allows businesses to sustain longer in cases where fund allocation gets delayed.

5. Use Finance Forecasting for Projections

Investors will often want to see your financial forecast. From revenue projections to growth, do a detailed finance forecast. Work with your financial advisors to create accurate projections to aid strategic decision-making.

6. Identify Gaps and Find Solutions

Perform regular audits to identify gaps within your existing financial system. These gaps, if ignored, can cause issues in the long run.

7. Ensure you’re Tax Compliant

Tax Compliance is basic sanity for any firm. It’s important to be tax compliant to avoid any legal issues in the future. Tax Compliance and keeping all the paperwork handy makes the funding process smoother. It assures the investors that the firm is in good shape.

8. Save on Taxes with Smart Tax Planning

Tax planning can help you save up to thousands of dollars! There are several tax credits and deductions, such as Accelerated Capital Cost Allowance (CCA), Industrial Research Assistance Program (IRAP), and Scientific Research and Experimental Development (SR&ED) Program, etc., that you can benefit from. You can use it for scaling business operations.

9. Maintain Accurate Financial Records

Investors will enquire about historical financial records. They use it to gauge the financial health of the business. Maintain accurate financial records and keep them handy. This will help your forecasts to be more accurate as a result

10. Outsource CFO

An outsourced CFO is an external finance leader that helps manage the business’s financial operations. Outsourcing CFO services will save costs when building an in-house team. You get curated financial services from the best-in-class experts. You can focus on your product development and growth instead of managing finances.

Read More: The ultimate guide to Outsourced CFO Services for fast-growth Businesses

11. Keep Scalability in Mind

Every system should be scalable. This ensures that the company can scale faster and quickly acquire market share. Investors ask for scalability. A scalable business is more likely to attract funding.

12. Have a robust growth plan

Growth is the key, and investors are always curious about your business’s growth potential. Having a clear path to revenue growth with carefully noted assumptions will help investors to believe that growth potential is possible.

13. Leverage Crowdfunding

Crowdfunding platforms can be a great way to raise funds. It would help validate your startup’s concept. By getting support from a large group of individuals, you can demonstrate to investors that there is demand for your product or service.

14. Have clearly defined Goals

Have clearly defined SMART Goals. Classify them as long-term, mid-term and short-term. You can track these goals using KPIs and Metrics. Share the goals with the investors. This will help them understand the vision of the company. It will also give them an idea of what lies ahead—making it easier to decide.

15. Seek Expert Legal Advisory

An expert legal advisor will help you comply with all the regulatory requirements. They will also help you navigate through the legalities of the funding process.

16. Use KPIs and Metrics to identify Risks and mitigate them

Keep track of your business’s health. Use relevant KPIs and Metrics for regular reporting. A well-structured reporting in place helps identify risks at the earliest. This helps save time and money. It also makes the business foolproof against any potential threats. You can mitigate the risks well ahead of time through continuous monitoring. This would help gain investors’ confidence, especially when they avert risks.

Read More: 10 Reporting KPIs Your Business Needs to Track

17. Be prepared to negotiate

Funding negotiations can be complex, and it’s essential to be prepared to negotiate fair and beneficial terms for both parties. Understand the terms of the deal and be ready to defend your valuation.

18. Network with HNIs to find the right Angel Investor

Angel investors are typically high-net-worth individuals (HNIs). They provide capital to startups in exchange for an ownership stake. Look for investors who have experience in your industry.

They can provide mentorship and guidance as well as funding. Some of the notable angel investor communities in Canada are:

19. Evaluate Debt Funding as an option

Debt funding can be a viable option for startups looking to raise capital. Consider Interest Rates, Repayment Terms, and Collateral at the first step. Debt financing can be a good option for startups that need to raise capital and have a clear repayment plan. However, it’s important to carefully evaluate the terms and risks associated with debt financing before accepting a loan.

20. Explore government funding opportunities

The Canadian government offers various funding programs and tax incentives for startups. Research these programs and determine which ones may apply to your startup. There are multiple options, such as:

- Scientific Research and Experimental Development (SR&ED) tax credits

- Industrial Research Assistance Program (IRAP)

- Canada Small Business Financing Program (CSBFP)

- Canada Media Fund (CMF)

- National Research Council of Canada (NRC) Industrial Research Assistance Program (IRAP)

- Futurpreneur Canada

21. Use technology to streamline financial processes

Adopting accounting and financial management software can help you:

- track expenses,

- manage invoices, and

- streamline financial reporting.

This can save time and reduce the risk of errors.

Conclusion

Although the market is going through a slowdown, you can still secure funding for your startup if you work on strengthening the fundamentals. As a Canadian Tech startup, you can follow the 21 Finance and Funding Tips mentioned above to prepare for your next funding round.

If you want to work with a strategic finance partner that can help you prepare your startup pre and post-funding, let’s chat. We can take care of your finances while you docs on growth.

Book an appointment to find the right Outsourcing CFO services for your business with Novaa.

Leave a Reply

Want to join the discussion?Feel free to contribute!